Fill Out a Valid Florida Child Support Calculator Template

Understanding how child support is calculated in the Sunshine State can be daunting, especially for parents navigating the complexities of family law for the first time. The Florida Family Law Rules of Procedure Form 12.902(e), commonly known as the Child Support Guidelines Worksheet, serves as a critical tool for this purpose. Its primary aim is to establish a fair and equitable amount of child support, considering the financial circumstances of both parents. The form is required whenever child support is requested, ensuring that the financial support provided is in the best interest of the child or children involved. By taking into account the combined income of the parents and the number of children, the guidelines chart embedded within the form offers a standardized way to calculate the support amount. Additionally, the worksheet details the steps to be followed if there is a desire to deviate from these guideline amounts. It is imperative for the form to be completed accurately and filed with the clerk of the circuit court in the pertinent county, with service to the other party as per Florida's legal requirements. Moreover, the form includes provisions for the confidentiality of addresses in cases of sexual battery or domestic violence. With changes to the guideline amounts possible, ensuring access to the most current chart is essential for accurate calculations. The worksheet not only encapsulates legal requirements but also provides a framework for the protection and welfare of children within the judicial system.

Document Preview Example

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM

12.902(e), CHILD SUPPORT GUIDELINES WORKSHEET (09/12)

When should this form be used?

You should complete this worksheet if child support is being requested in your case. If you know the

income of the other party, this worksheet should accompany your financial affidavit. If you do not k o the other party’s income, this form must be completed after the other party files his or her

financial affidavit, and serves a copy on you.

This form should be typed or printed in black ink. You should file the original with the clerk of the circuit court in the county where your case is filed and keep a copy for your records.

What should I do next?

A copy of this form must be served on the other party in your case. Service must be in accordance with Florida Rule of Judicial Administration 2.516.

Where can I look for more information?

Before proceedi g, you should read Ge eral I for atio for

Special notes...

If you want to keep your address confidential because you are the victim of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery or domestic violence, do not enter the address, telephone, and fax information at the bottom of this form. Instead, file Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

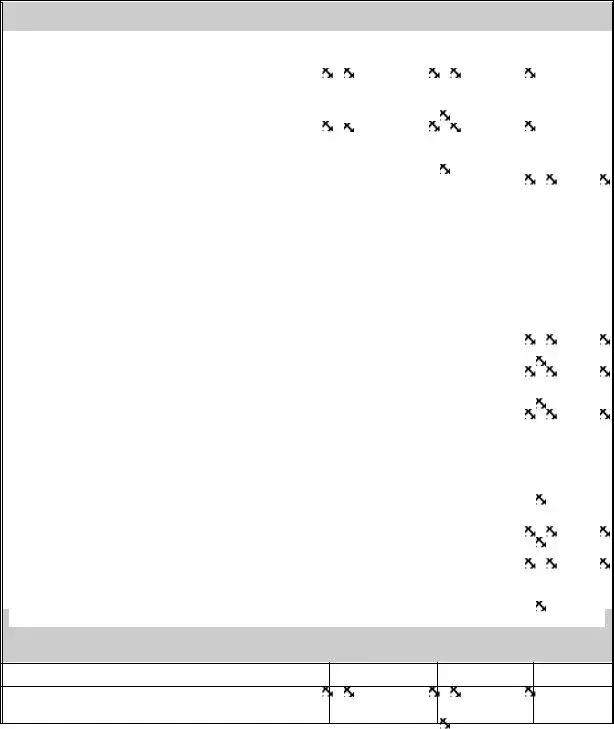

The chart below contains the guideline amounts that you should use when calculating child support. This amount is based on the number of children and the combined income of the parents, and it is divided between the parents in direct proportion to their income or earning capacity. From time to time, some of the amounts in the child support guidelines chart will change. Be sure you have the most recent version of the chart before using it.

Because the guidelines are based on monthly amounts, it may be necessary to convert some income and expense figures from other frequencies to monthly. You should do this as follows:

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

If payment is twice per month |

Payment amount |

x |

2 |

= |

Monthly amount |

If payment is every two weeks |

Payment amount |

x |

26 |

= |

Yearly amount due |

|

Yearly amount |

÷ |

12 |

= |

Monthly amount |

If payment is weekly |

Weekly amount |

x |

52 |

= |

Yearly amount due |

|

Yearly amount |

÷ |

12 |

= |

Monthly amount |

If you or the other parent request that the court award an amount that is different than the guideline amount, you must also complete and attach a Motion to Deviate from Child Support Guidelines, Florida Supreme Court Approved Family Law Form 12.943.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these forms, that person must give you a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also must put his or her name, address, and telephone number on the bottom of the last page of every form he or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES CHART

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

800.00 |

190 |

211 |

213 |

216 |

218 |

220 |

|

850.00 |

202 |

257 |

259 |

262 |

265 |

268 |

|

900.00 |

213 |

302 |

305 |

309 |

312 |

315 |

|

950.00 |

224 |

347 |

351 |

355 |

359 |

363 |

|

1000.00 |

235 |

365 |

397 |

402 |

406 |

410 |

|

1050.00 |

246 |

382 |

443 |

448 |

453 |

458 |

|

1100.00 |

258 |

400 |

489 |

495 |

500 |

505 |

|

1150.00 |

269 |

417 |

522 |

541 |

547 |

553 |

|

1200.00 |

280 |

435 |

544 |

588 |

594 |

600 |

|

1250.00 |

290 |

451 |

565 |

634 |

641 |

648 |

|

1300.00 |

300 |

467 |

584 |

659 |

688 |

695 |

|

1350.00 |

310 |

482 |

603 |

681 |

735 |

743 |

|

1400.00 |

320 |

498 |

623 |

702 |

765 |

790 |

|

1450.00 |

330 |

513 |

642 |

724 |

789 |

838 |

|

1500.00 |

340 |

529 |

662 |

746 |

813 |

869 |

|

1550.00 |

350 |

544 |

681 |

768 |

836 |

895 |

|

1600.00 |

360 |

560 |

701 |

790 |

860 |

920 |

|

1650.00 |

370 |

575 |

720 |

812 |

884 |

945 |

|

1700.00 |

380 |

591 |

740 |

833 |

907 |

971 |

|

1750.00 |

390 |

606 |

759 |

855 |

931 |

996 |

|

1800.00 |

400 |

622 |

779 |

877 |

955 |

1022 |

|

1850.00 |

410 |

638 |

798 |

900 |

979 |

1048 |

|

1900.00 |

421 |

654 |

818 |

923 |

1004 |

1074 |

|

1950.00 |

431 |

670 |

839 |

946 |

1029 |

1101 |

|

2000.00 |

442 |

686 |

859 |

968 |

1054 |

1128 |

|

2050.00 |

452 |

702 |

879 |

991 |

1079 |

1154 |

|

2100.00 |

463 |

718 |

899 |

1014 |

1104 |

1181 |

|

2150.00 |

473 |

734 |

919 |

1037 |

1129 |

1207 |

|

2200.00 |

484 |

751 |

940 |

1060 |

1154 |

1234 |

|

2250.00 |

494 |

767 |

960 |

1082 |

1179 |

1261 |

|

2300.00 |

505 |

783 |

980 |

1105 |

1204 |

1287 |

|

2350.00 |

515 |

799 |

1000 |

1128 |

1229 |

1314 |

|

2400.00 |

526 |

815 |

1020 |

1151 |

1254 |

1340 |

|

2450.00 |

536 |

831 |

1041 |

1174 |

1279 |

1367 |

|

2500.00 |

547 |

847 |

1061 |

1196 |

1304 |

1394 |

|

2550.00 |

557 |

864 |

1081 |

1219 |

1329 |

1420 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

2600.00 |

568 |

880 |

1101 |

1242 |

1354 |

1447 |

|

2650.00 |

578 |

896 |

1121 |

1265 |

1379 |

1473 |

|

2700.00 |

588 |

912 |

1141 |

1287 |

1403 |

1500 |

|

2750.00 |

597 |

927 |

1160 |

1308 |

1426 |

1524 |

|

2800.00 |

607 |

941 |

1178 |

1328 |

1448 |

1549 |

|

2850.00 |

616 |

956 |

1197 |

1349 |

1471 |

1573 |

|

2900.00 |

626 |

971 |

1215 |

1370 |

1494 |

1598 |

|

2950.00 |

635 |

986 |

1234 |

1391 |

1517 |

1622 |

|

3000.00 |

644 |

1001 |

1252 |

1412 |

1540 |

1647 |

|

3050.00 |

654 |

1016 |

1271 |

1433 |

1563 |

1671 |

|

3100.00 |

663 |

1031 |

1289 |

1453 |

1586 |

1695 |

|

3150.00 |

673 |

1045 |

1308 |

1474 |

1608 |

1720 |

|

3200.00 |

682 |

1060 |

1327 |

1495 |

1631 |

1744 |

|

3250.00 |

691 |

1075 |

1345 |

1516 |

1654 |

1769 |

|

3300.00 |

701 |

1090 |

1364 |

1537 |

1677 |

1793 |

|

3350.00 |

710 |

1105 |

1382 |

1558 |

1700 |

1818 |

|

3400.00 |

720 |

1120 |

1401 |

1579 |

1723 |

1842 |

|

3450.00 |

729 |

1135 |

1419 |

1599 |

1745 |

1867 |

|

3500.00 |

738 |

1149 |

1438 |

1620 |

1768 |

1891 |

|

3550.00 |

748 |

1164 |

1456 |

1641 |

1791 |

1915 |

|

3600.00 |

757 |

1179 |

1475 |

1662 |

1814 |

1940 |

|

3650.00 |

767 |

1194 |

1493 |

1683 |

1837 |

1964 |

|

3700.00 |

776 |

1208 |

1503 |

1702 |

1857 |

1987 |

|

3750.00 |

784 |

1221 |

1520 |

1721 |

1878 |

2009 |

|

3800.00 |

793 |

1234 |

1536 |

1740 |

1899 |

2031 |

|

3850.00 |

802 |

1248 |

1553 |

1759 |

1920 |

2053 |

|

3900.00 |

811 |

1261 |

1570 |

1778 |

1940 |

2075 |

|

3950.00 |

819 |

1275 |

1587 |

1797 |

1961 |

2097 |

|

4000.00 |

828 |

1288 |

1603 |

1816 |

1982 |

2119 |

|

4050.00 |

837 |

1302 |

1620 |

1835 |

2002 |

2141 |

|

4100.00 |

846 |

1315 |

1637 |

1854 |

2023 |

2163 |

|

4150.00 |

854 |

1329 |

1654 |

1873 |

2044 |

2185 |

|

4200.00 |

863 |

1342 |

1670 |

1892 |

2064 |

2207 |

|

4250.00 |

872 |

1355 |

1687 |

1911 |

2085 |

2229 |

|

4300.00 |

881 |

1369 |

1704 |

1930 |

2106 |

2251 |

|

4350.00 |

889 |

1382 |

1721 |

1949 |

2127 |

2273 |

|

4400.00 |

898 |

1396 |

1737 |

1968 |

2147 |

2295 |

|

4450.00 |

907 |

1409 |

1754 |

1987 |

2168 |

2317 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

4500.00 |

916 |

1423 |

1771 |

2006 |

2189 |

2339 |

|

4550.00 |

924 |

1436 |

1788 |

2024 |

2209 |

2361 |

|

4600.00 |

933 |

1450 |

1804 |

2043 |

2230 |

2384 |

|

4650.00 |

942 |

1463 |

1821 |

2062 |

2251 |

2406 |

|

4700.00 |

951 |

1477 |

1838 |

2081 |

2271 |

2428 |

|

4750.00 |

959 |

1490 |

1855 |

2100 |

2292 |

2450 |

|

4800.00 |

968 |

1503 |

1871 |

2119 |

2313 |

2472 |

|

4850.00 |

977 |

1517 |

1888 |

2138 |

2334 |

2494 |

|

4900.00 |

986 |

1530 |

1905 |

2157 |

2354 |

2516 |

|

4950.00 |

993 |

1542 |

1927 |

2174 |

2372 |

2535 |

|

5000.00 |

1000 |

1551 |

1939 |

2188 |

2387 |

2551 |

|

5050.00 |

1006 |

1561 |

1952 |

2202 |

2402 |

2567 |

|

5100.00 |

1013 |

1571 |

1964 |

2215 |

2417 |

2583 |

|

5150.00 |

1019 |

1580 |

1976 |

2229 |

2432 |

2599 |

|

5200.00 |

1025 |

1590 |

1988 |

2243 |

2447 |

2615 |

|

5250.00 |

1032 |

1599 |

2000 |

2256 |

2462 |

2631 |

|

5300.00 |

1038 |

1609 |

2012 |

2270 |

2477 |

2647 |

|

5350.00 |

1045 |

1619 |

2024 |

2283 |

2492 |

2663 |

|

5400.00 |

1051 |

1628 |

2037 |

2297 |

2507 |

2679 |

|

5450.00 |

1057 |

1638 |

2049 |

2311 |

2522 |

2695 |

|

5500.00 |

1064 |

1647 |

2061 |

2324 |

2537 |

2711 |

|

5550.00 |

1070 |

1657 |

2073 |

2338 |

2552 |

2727 |

|

5600.00 |

1077 |

1667 |

2085 |

2352 |

2567 |

2743 |

|

5650.00 |

1083 |

1676 |

2097 |

2365 |

2582 |

2759 |

|

5700.00 |

1089 |

1686 |

2109 |

2379 |

2597 |

2775 |

|

5750.00 |

1096 |

1695 |

2122 |

2393 |

2612 |

2791 |

|

5800.00 |

1102 |

1705 |

2134 |

2406 |

2627 |

2807 |

|

5850.00 |

1107 |

1713 |

2144 |

2418 |

2639 |

2820 |

|

5900.00 |

1111 |

1721 |

2155 |

2429 |

2651 |

2833 |

|

5950.00 |

1116 |

1729 |

2165 |

2440 |

2663 |

2847 |

|

6000.00 |

1121 |

1737 |

2175 |

2451 |

2676 |

2860 |

|

6050.00 |

1126 |

1746 |

2185 |

2462 |

2688 |

2874 |

|

6100.00 |

1131 |

1754 |

2196 |

2473 |

2700 |

2887 |

|

6150.00 |

1136 |

1762 |

2206 |

2484 |

2712 |

2900 |

|

6200.00 |

1141 |

1770 |

2216 |

2495 |

2724 |

2914 |

|

6250.00 |

1145 |

1778 |

2227 |

2506 |

2737 |

2927 |

|

6300.00 |

1150 |

1786 |

2237 |

2517 |

2749 |

2941 |

|

6350.00 |

1155 |

1795 |

2247 |

2529 |

2761 |

2954 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

6400.00 |

1160 |

1803 |

2258 |

2540 |

2773 |

2967 |

|

6450.00 |

1165 |

1811 |

2268 |

2551 |

2785 |

2981 |

|

6500.00 |

1170 |

1819 |

2278 |

2562 |

2798 |

2994 |

|

6550.00 |

1175 |

1827 |

2288 |

2573 |

2810 |

3008 |

|

6600.00 |

1179 |

1835 |

2299 |

2584 |

2822 |

3021 |

|

6650.00 |

1184 |

1843 |

2309 |

2595 |

2834 |

3034 |

|

6700.00 |

1189 |

1850 |

2317 |

2604 |

2845 |

3045 |

|

6750.00 |

1193 |

1856 |

2325 |

2613 |

2854 |

3055 |

|

6800.00 |

1196 |

1862 |

2332 |

2621 |

2863 |

3064 |

|

6850.00 |

1200 |

1868 |

2340 |

2630 |

2872 |

3074 |

|

6900.00 |

1204 |

1873 |

2347 |

2639 |

2882 |

3084 |

|

6950.00 |

1208 |

1879 |

2355 |

2647 |

2891 |

3094 |

|

7000.00 |

1212 |

1885 |

2362 |

2656 |

2900 |

3103 |

|

7050.00 |

1216 |

1891 |

2370 |

2664 |

2909 |

3113 |

|

7100.00 |

1220 |

1897 |

2378 |

2673 |

2919 |

3123 |

|

7150.00 |

1224 |

1903 |

2385 |

2681 |

2928 |

3133 |

|

7200.00 |

1228 |

1909 |

2393 |

2690 |

2937 |

3142 |

|

7250.00 |

1232 |

1915 |

2400 |

2698 |

2946 |

3152 |

|

7300.00 |

1235 |

1921 |

2408 |

2707 |

2956 |

3162 |

|

7350.00 |

1239 |

1927 |

2415 |

2716 |

2965 |

3172 |

|

7400.00 |

1243 |

1933 |

2423 |

2724 |

2974 |

3181 |

|

7450.00 |

1247 |

1939 |

2430 |

2733 |

2983 |

3191 |

|

7500.00 |

1251 |

1945 |

2438 |

2741 |

2993 |

3201 |

|

7550.00 |

1255 |

1951 |

2446 |

2750 |

3002 |

3211 |

|

7600.00 |

1259 |

1957 |

2453 |

2758 |

3011 |

3220 |

|

7650.00 |

1263 |

1963 |

2461 |

2767 |

3020 |

3230 |

|

7700.00 |

1267 |

1969 |

2468 |

2775 |

3030 |

3240 |

|

7750.00 |

1271 |

1975 |

2476 |

2784 |

3039 |

3250 |

|

7800.00 |

1274 |

1981 |

2483 |

2792 |

3048 |

3259 |

|

7850.00 |

1278 |

1987 |

2491 |

2801 |

3057 |

3269 |

|

7900.00 |

1282 |

1992 |

2498 |

2810 |

3067 |

3279 |

|

7950.00 |

1286 |

1998 |

2506 |

2818 |

3076 |

3289 |

|

8000.00 |

1290 |

2004 |

2513 |

2827 |

3085 |

3298 |

|

8050.00 |

1294 |

2010 |

2521 |

2835 |

3094 |

3308 |

|

8100.00 |

1298 |

2016 |

2529 |

2844 |

3104 |

3318 |

|

8150.00 |

1302 |

2022 |

2536 |

2852 |

3113 |

3328 |

|

8200.00 |

1306 |

2028 |

2544 |

2861 |

3122 |

3337 |

|

8250.00 |

1310 |

2034 |

2551 |

2869 |

3131 |

3347 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

8300.00 |

1313 |

2040 |

2559 |

2878 |

3141 |

3357 |

|

8350.00 |

1317 |

2046 |

2566 |

2887 |

3150 |

3367 |

|

8400.00 |

1321 |

2052 |

2574 |

2895 |

3159 |

3376 |

|

8450.00 |

1325 |

2058 |

2581 |

2904 |

3168 |

3386 |

|

8500.00 |

1329 |

2064 |

2589 |

2912 |

3178 |

3396 |

|

8550.00 |

1333 |

2070 |

2597 |

2921 |

3187 |

3406 |

|

8600.00 |

1337 |

2076 |

2604 |

2929 |

3196 |

3415 |

|

8650.00 |

1341 |

2082 |

2612 |

2938 |

3205 |

3425 |

|

8700.00 |

1345 |

2088 |

2619 |

2946 |

3215 |

3435 |

|

8750.00 |

1349 |

2094 |

2627 |

2955 |

3224 |

3445 |

|

8800.00 |

1352 |

2100 |

2634 |

2963 |

3233 |

3454 |

|

8850.00 |

1356 |

2106 |

2642 |

2972 |

3242 |

3464 |

|

8900.00 |

1360 |

2111 |

2649 |

2981 |

3252 |

3474 |

|

8950.00 |

1364 |

2117 |

2657 |

2989 |

3261 |

3484 |

|

9000.00 |

1368 |

2123 |

2664 |

2998 |

3270 |

3493 |

|

9050.00 |

1372 |

2129 |

2672 |

3006 |

3279 |

3503 |

|

9100.00 |

1376 |

2135 |

2680 |

3015 |

3289 |

3513 |

|

9150.00 |

1380 |

2141 |

2687 |

3023 |

3298 |

3523 |

|

9200.00 |

1384 |

2147 |

2695 |

3032 |

3307 |

3532 |

|

9250.00 |

1388 |

2153 |

2702 |

3040 |

3316 |

3542 |

|

9300.00 |

1391 |

2159 |

2710 |

3049 |

3326 |

3552 |

|

9350.00 |

1395 |

2165 |

2717 |

3058 |

3335 |

3562 |

|

9400.00 |

1399 |

2171 |

2725 |

3066 |

3344 |

3571 |

|

9450.00 |

1403 |

2177 |

2732 |

3075 |

3353 |

3581 |

|

9500.00 |

1407 |

2183 |

2740 |

3083 |

3363 |

3591 |

|

9550.00 |

1411 |

2189 |

2748 |

3092 |

3372 |

3601 |

|

9600.00 |

1415 |

2195 |

2755 |

3100 |

3381 |

3610 |

|

9650.00 |

1419 |

2201 |

2763 |

3109 |

3390 |

3620 |

|

9700.00 |

1422 |

2206 |

2767 |

3115 |

3396 |

3628 |

|

9750.00 |

1425 |

2210 |

2772 |

3121 |

3402 |

3634 |

|

9800.00 |

1427 |

2213 |

2776 |

3126 |

3408 |

3641 |

|

9850.00 |

1430 |

2217 |

2781 |

3132 |

3414 |

3647 |

|

9900.00 |

1432 |

2221 |

2786 |

3137 |

3420 |

3653 |

|

9950.00 |

1435 |

2225 |

2791 |

3143 |

3426 |

3659 |

|

10000.00 |

1437 |

2228 |

2795 |

3148 |

3432 |

3666 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

IN THE CIRCUIT COURT OF THE |

|

|

|

|

JUDICIAL CIRCUIT, |

||

IN AND FOR |

|

|

COUNTY, FLORIDA |

||||

|

|

|

Case No.: |

|

|||

|

|

|

Division: |

||||

|

, |

|

|

|

|

|

|

Petitioner, |

|

|

|

|

|

||

and |

|

|

|

|

|

||

|

, |

|

|

|

|

|

|

Respondent. |

|

|

|

|

|

||

NOTICE OF FILING CHILD SUPPORT GUIDELINES WORKSHEET

PLEASE TAKE NOTICE, that {name} |

_______, is filing his/her |

|

|

|

|

Child Support Guidelines Worksheet attached and labeled Exhibit 1.

CERTIFICATE OF SERVICE

I certify that a copy of this Notice of Filing with the Child Support Guidelines Worksheet was

[check all used]: ( ) |

) mailed ( ) faxed ( ) hand delivered to the person(s) listed |

||

below on {date} |

|

__________. |

|

|

|

|

|

Other party or his/her attorney:

Name: _____________________________

Address: ____________________________

City, State, Zip: _______________________

Fax Number: _________________________

Signature of Party or his/her Attorney

Printed Name: _________________________

Address: ____________________________

City, State, Zip: _______________________

Fax Number: _________________________

Florida Bar Number: ____________________

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES WORKSHEET

|

|

|

|

A. FATHER |

B. MOTHER |

TOTAL |

|

|

|

|

|

|

|

|

1. Present Net Monthly Income |

|

|

|

|

|

|

Enter the amount from line 27, Section I of |

|

|

|

||

|

Florida Family Law Rules of Procedure Form |

|

|

|

||

|

12.902(b) or (c), Financial Affidavit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Basic Monthly Obligation |

|

|

|

|

|

|

There is (are) {number}_____ minor child(ren) |

|

|

|

||

|

common to the parties. |

|

|

|

|

|

|

Using the total amount from line 1, enter the |

|

|

|

||

|

appropriate amount from the child support |

|

|

|

||

|

guidelines chart. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Percent of Financial Responsibility |

|

% |

% |

|

|

|

Divide the amount on line 1A by the total |

|

|

|

||

|

a |

ou t o li e 1 to get Father’s per e |

tage of |

|

|

|

|

financial responsibility. Enter answer on line 3A. |

|

|

|

||

|

Divide the amount on line 1B by the total |

|

|

|

||

|

a |

ou t o li e 1 to get Mother’s per e |

tage of |

|

|

|

|

financial responsibility. Enter answer on line 3B. |

|

|

|

||

|

|

|

|

|

|

|

|

4. Share of Basic Monthly Obligation |

|

|

|

|

|

|

Multiply the number on line 2 by the |

|

|

|

|

|

|

per e tage o li e 3A to get Father’s share |

|

|

|

||

|

of basic obligation. Enter answer on line 4A. |

|

|

|

||

|

Multiply the number on line 2 by the |

|

|

|

|

|

|

per e tage o li e 3B to get Mother’s share |

|

|

|

||

|

of basic obligation. Enter answer on line 4B. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Support — Health Insurance, Child Care & Other |

|

|||

|

|

|

|

|

|

|

|

5. a. 100% of Monthly Child Care Costs |

|

|

|

|

|

|

|

[Child care costs should not exceed the level |

|

|

|

|

|

|

required to provide quality care from a |

|

|

|

|

|

|

licensed source. See section 61.30(7), Florida |

|

|

|

|

|

|

Statutes, for more information.] |

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Total Mo thly Child re ’s Health Insurance |

|

|

|

|

|

|

Cost |

|

|

|

|

|

|

[This is only amounts actually paid for |

|

|

|

|

|

|

health insurance on the child(ren).] |

|

|

|

|

|

|

|

|

|

|

|

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES WORKSHEET

|

|

|

|

|

A. FATHER |

B. MOTHER |

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Total Mo thly Child re ’s No |

o ered |

|

|

|

|

|

|

|

Medical, Dental and Prescription |

|

|

|

|

|

|

|

|

Medication Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. |

Total Monthly Child Care & Health Costs |

|

|

|

|

|

|

|

|

[Add lines 5a + 5b +5c]. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Additional Support Payments |

|

|

|

|

|

||

|

|

Multiply the number on line 5d by the |

|

|

|

|

||

|

|

per e tage o li e 3A to deter i |

e the Father’s |

|

|

|

|

|

|

|

share. Enter answer on line 6A. Multiply the |

|

|

|

|

||

|

|

number on line 5d by the percentage on line 3B |

|

|

|

|

||

|

|

to deter i e the Mother’s share. |

|

|

|

|

|

|

|

|

Enter answer on line 6B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statutory Adjustments/Credits |

|

|

|

||

7. |

a. Monthly child care payments actually made |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

b. |

Monthly health insurance payments actually |

|

|

|

|

|

|

|

|

made |

|

|

|

|

|

|

|

c. |

Other payments/credits actually made for |

|

|

|

|

|

|

|

|

any noncovered medical, dental and |

|

|

|

|

|

|

|

|

prescription medication expenses of the |

|

|

|

|

|

|

|

|

child(ren) not ordered to be separately paid |

|

|

|

|

|

|

|

|

on a percentage basis. |

|

|

|

|

|

|

|

|

(See section 61.30 (8), Florida Statutes) |

|

|

|

|

|

|

8. Total Support Payments actually made |

|

|

|

|

|||

|

|

(Add 7a though 7c) |

|

|

|

|

|

|

|

9. MINIMUM CHILD SUPPORT OBLIGATION FOR |

|

|

|

|

|||

|

|

EACH PARENT |

|

|

|

|

|

|

|

|

[Line 4 plus line 6; minus line 8] |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Substantial |

|

|||||

|

|

|

|

|

|

|

|

|

percent of the overnights in the year (73 overnights in the year), complete Nos. 10 through 21

A. FATHER |

B. MOTHER |

TOTAL |

10. Basic Monthly Obligation x 150% [Multiply line 2 by 1.5]

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Document Overview

| Fact Name | Fact Detail |

|---|---|

| Document Title | Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12) |

| Primary Use | Completing this worksheet is necessary when child support is being requested in a case. |

| Income Documentation | This form should be accompanied by a financial affidavit if you know the other party's income. |

| When to Complete | The form must be completed after the other party files their financial affidavit and serves a copy on you if their income is unknown. |

| Filing Requirements | The original form should be filed with the clerk of the circuit court in the county where the case is filed, and you should keep a copy for your records. |

| Service to the Other Party | A copy of this form must be served on the other party in accordance with Florida Rule of Judicial Administration 2.516. |

| Guideline Amounts | Child support amounts are calculated based on the number of children and the combined monthly income of the parents, divided in proportion to their income or earning capacity. |

| Income Conversion | Instructions are provided for converting income and expense figures from other frequencies to monthly amounts. |

| Requesting Different Amounts | If requesting a child support amount different from the guideline, a Motion to Deviate from Child Support Guidelines must be completed and attached. |

| Nonlawyer Assistance | A nonlawyer helping fill out the form must provide a copy of a Disclosure from Nonlawyer and include their name, address, and telephone number on the form. |

| Governing Law | The form and procedures are governed by section 61.30, Florida Statutes. |

Instructions on How to Fill Out Florida Child Support Calculator

Filing for child support can often seem like navigating through a maze without a map. However, in the state of Florida, the process is made somewhat easier with the use of a specific form: the Florida Child Support Guidelines Worksheet, also known as Form 12.902(e). This form is crucial when one party is requesting child support as it helps calculate the amount of support that should be paid, based on both parties' incomes and the number of children involved. The worksheet uses a chart to guide calculations, ensuring the support amount aligns with Florida’s legal standards. To ensure you're compliant and have accurately filled out your form, follow these steps meticulously and double-check your work before submission.

- Ensure that you have the most current version of Form 12.902(e), the Child Support Guidelines Worksheet.

- Start by reading the instructions carefully to understand the information required and how the form should be completed.

- Type or print your answers in black ink to make sure the document is legible and meets filing standards.

- Gather financial information for both parties, including your monthly income and that of the other party, if known. If you do not know the other party’s income, wait until they have filed their financial affidavit and served a copy to you before completing the form.

- Refer to the Child Support Guidelines Chart included in the instructions to find the base amount of support corresponding to your combined monthly available income and the number of children.

- Adjust your income amounts to a monthly figure if they are not already in this format, using the conversion method provided in the instructions:

- If payment is twice per month: Payment amount x 2 = Monthly amount

- If payment is every two weeks: Payment amount x 26 / 12 = Monthly amount

- If payment is weekly: Payment amount x 52 / 12 = Monthly amount

- Fill out each section of the form accordingly, ensuring all necessary fields are complete and accurate.

- If applicable, complete and attach a Motion to Deviate from Child Support Guidelines, using Form 12.943, to request a support amount different from the guideline.

- Before submitting the form, verify that all information is correct and that no required information is missing. Accuracy is key to ensuring the child support amount calculated is fair and in accordance with Florida law.

- File the original Form 12.902(e) with the clerk of the circuit court in the county where your case is filed. Remember to keep a copy for your personal records.

- Finally, serve a copy of this form on the other party in your case, following the rules outlined in Florida Rule of Judicial Administration 2.516.

After these steps are completed, the calculation provided by the Florida Child Support Guidelines Worksheet will have helped you propose a child support amount that reflects both parents' financial capabilities and the needs of the children involved. It’s a critical part of ensuring fairness and compliance with Florida's child support laws.

Listed Questions and Answers

When is it necessary to use the Florida Child Support Guidelines Worksheet?

The worksheet should be filled out when child support is being requested in your case. It's crucial to complete this form if you have information on the other party's income or after they have filed their financial affidavit and served a copy on you.

What steps should be taken after completing the worksheet?

After filling out the form, serve a copy on the opposing party according to Florida Rule of Judicial Administration 2.516. Ensure to file the original form with the clerk of the circuit court in the county where your case is being heard and retain a copy for your records.

Where can more information about the process be found?

For additional information, reviewing the "General Information for Self-Represented Litigants" at the beginning of the forms is recommended. Also, refer to section 61.30, Florida Statutes, for more details.

How often are the amounts in the child support guidelines chart updated?

The amounts in the chart may change periodically. It is vital to ensure you are using the most recent version of the chart for accurate calculations.

How should income and expenses be converted to monthly amounts?

For payments received twice per month, multiply by 2. If payments are bi-weekly, multiply the amount by 26 and then divide by 12. Weekly payments should be multiplied by 52, then divided by 12 to find the monthly amount.

What if the court is requested to deviate from the guideline amount?

If there's a request for child support that differs from the guideline amount, a Motion to Deviate from Child Support Guidelines must be completed and attached to your paperwork.

Can a nonlawyer help fill out these forms?

Yes, but the nonlawyer must provide you with a copy of the Disclosure from Nonlawyer form before assisting you. They also have to include their contact information at the bottom of every form they help with.

How is child support calculated for multiple children?

The guidelines provide amounts based on the combined monthly income of the parents and the number of children. This amount changes with income levels and the number of children, and it's shared between the parents according to their income or earning ability.

What documentation should I keep for my records?

Always keep a copy of the completed worksheet and any other documents filed with the court or served on the other party for your personal records.

What action should be taken if a parent's income changes?

If there’s a significant change in a parent's income, it may be necessary to modify the child support order. You should consult legal advice on how to proceed with modifying the child support agreement in court.

Common mistakes

Filling out the Florida Child Support Calculator form, also known as Florida Family Law Rules of Procedure Form 12.902(e), is a critical step in ensuring the appropriate determination of child support payments. However, individuals often stumble on common pitfalls during the completion of this form. Awareness and careful avoidance of these missteps can significantly impact the accuracy of the support calculation. Let's explore nine common mistakes made during this process:

- Not Using the Most Recent Guidelines Chart: The child support guidelines chart is updated periodically. Using an outdated version can lead to incorrect support amounts.

- Incorrect Income Reporting: Either overestimating or underestimating income, including forgetting to include all sources of income, can distort the child support calculations.

- Failure to Convert Income Correctly: Not correctly converting weekly, bi-weekly, or twice per month payments to a monthly amount can result in inaccuracies.

- Not Accounting for All Children: If the non-custodial parent has other children they support, this can affect the calculation, but it's often overlooked.

- Omitting Health Insurance Costs: Health insurance costs for the children involved should be included in the calculation, a step that is sometimes forgotten.

- Incorrectly Dividing Parental Responsibility: The form requires information on the division of time the child spends with each parent, which can significantly influence the support amount but is often miscalculated or misunderstood.

- Overlooking Additional Expenses: Not including childcare, educational, and special needs expenses can lead to an inaccurate support amount.

- Not Filing a Motion When Applicable: If there’s a reason to deviate from the guideline amount, failing to complete and attach a Motion to Deviate from Child Support Guidelines can be a missed opportunity to present a fair argument.

- Improper Service: Once completed, the form must be correctly served on the other party in accordance with Florida Rule of Judicial Administration 2.516, which is sometimes done improperly.

It's essential for individuals completing the Florida Child Support Calculator form to approach the task with attention to detail and an understanding of the guidelines. Avoiding these common pitfalls can help ensure that the child support amount calculated is fair and accurate, reflecting the true needs of the child or children involved.

Documents used along the form

When dealing with child support calculations in Florida, the Child Support Guidelines Worksheet, as outlined in the form 12.902(e), serves as a crucial document in the process. However, to effectively navigate and substantiate the data required for this worksheet, individuals may need to utilize additional forms and documents. These supplementary documents help provide a comprehensive overview of the financial situation of both parties involved, ensuring that child support calculations are accurate and fair. They include:

- Financial Affidavit (Short Form) - Form 12.902(b): This document is used when an individual’s annual income is less than $50,000. It provides a detailed account of their financial status, including assets, liabilities, income, and expenses.

- Financial Affidavit (Long Form) - Form 12.902(c): For those earning more than $50,000 annually, this detailed form captures comprehensive financial information, including monthly household expenses, assets, liabilities, and all sources of income.

- Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA) Affidavit - Form 12.902(d): This affidavit is necessary when minor children are involved in the case. It provides information on the children's residence history, which is crucial for establishing jurisdiction over custody matters.

- Parenting Plan – Form 12.995(a) or (b): This document outlines the agreement between the parents regarding the care, custody, and support of their children. It typically details parenting schedules, decision-making responsibilities, and how child support obligations align with shared parenting arrangements.

- Notice of Social Security Number - Form 12.902(j): Required in family law cases, this form ensures that the social security numbers of both parents and the children are accurately recorded, which is essential for processing child support payments.

- Child Support Guidelines Chart: Not a form per se, but an essential tool referenced by the Child Support Guidelines Worksheet. It helps calculate the appropriate childssupport amount based on the parents’ combined income and the number of children.

Gathering and accurately completing these forms can greatly facilitate the process of determining child support, as they offer a clear picture of the financial circumstances of both parents and the needs of the involved children. Having accurate and thorough documentation ready can simplify negotiations and assist in the creation of a fair and adequate child support arrangement, as dictated by Florida law.

Similar forms

The Florida Child Support Calculator form is similar to financial affidavit forms used in divorce and child custody cases. Financial affidavits are documents that require individuals to disclose their income, expenses, assets, and liabilities. Like the Child Support Calculator, they play a crucial role in legal proceedings by providing a foundation for determining financial obligations, such as child support or alimony. Both documents require detailed financial information to ensure that support orders are fair and reflect the parties' ability to pay. However, while the Child Support Calculator specifically focuses on calculating child support based on the parents' combined income and the number of children, financial affidavits cover a broader range of financial data, including individual expenses and debts.

Another document the Florida Child Support Calculator form closely resembles is the Income and Expense Declaration (FL-150) in jurisdictions like California. This form, similar to the financial affidavit, requires detailed information about an individual’s monthly income and expenses. Both the Child Support Calculator and the Income and Expense Declaration are designed to capture accurate financial pictures of the parties involved, which are critical for determining appropriate child support amounts. They both include sections for reporting income from all sources and calculating monthly expenses, although the Child Support Calculator is more narrowly focused on determining the proportional amount each parent should contribute to child support, directly impacting the outcome of that specific aspect of family law cases.

Dos and Don'ts

Filling out the Florida Child Support Calculator form accurately is crucial for determining the proper amount of support for your child. Here are some essential dos and don'ts to help guide you through the process:

- Do ensure you have the most recent version of the child support guidelines chart before you start.

- Do convert all your income and expenses figures to their monthly equivalents if they are not already in this format, using the conversion instructions provided.

- Do complete the worksheet thoroughly, typing or printing in black ink to ensure legibility.

- Do file the original worksheet with the clerk of the circuit court in the county where your case is filed and keep a copy for your records.

- Do serve a copy of the form on the other party in your case, following the rules set forth in Florida Rule of Judicial Administration 2.516.

- Don't leave any sections blank if they apply to your situation. Incomplete forms can lead to delays or inaccuracies in child support calculations.

- Don't include your address or contact information on the form if you are a victim of crime (such as domestic violence or stalking) and want to keep your address confidential. Instead, file a Request for Confidential Filing of Address.

- Don't guess the income of the other party. If you do not know it, wait to complete the form until after the other party has submitted their financial affidavit and served a copy on you.

- Don't attempt to adjust the guideline support amount on your own if you believe a different amount is warranted. In such cases, you must complete and attach a Motion to Deviate from Child Support Guidelines.

Misconceptions

There are several common misconceptions about the Florida Child Support Calculator form, a tool used within the family law system to calculate financial support for children. Understanding these misconceptions can clarify the process for families navigating through child support calculations.

- Misconception #1: The calculator results are just suggestions, not enforceable.

- Misconception #2: Only the income of the non-custodial parent is considered.

- Misconception #3: My expenses will significantly lower my child support payments.

- Misconception #4: The form automatically accounts for shared custody arrangements.

- Misconception #5: The calculated amount covers all expenses for the child.

- Misconception #6: Once set, the child support amount is fixed until the child turns 18.

Contrary to this belief, the results from the Florida Child Support Calculator form are based on statutory guidelines and can be enforced by a court. These amounts are not merely advisory; they form the basis of court orders for child support.

Both parents' incomes are taken into account when calculating child support. Florida's model is income shares, meaning the child support amount reflects what the child would receive if the parents were still together, based on both parents' combined income.

Individual expenses of the parents are largely irrelevant in calculating child support. The formula primarily focuses on the income of the parents and the number of children. Personal debts and obligations outside of basic necessities have little impact on the calculation.

While shared custody can impact the child support calculation, simply using the calculator without adjusting for the substantial amount of time the child spends with each parent can lead to inaccurate results. A more detailed analysis is required for shared custody situations.

The child support amount is intended to cover the child's basic needs, such as food, clothing, and shelter. It may not cover all expenses, such as extracurricular activities or college savings, which are often handled separately.

Child support amounts can be modified if there is a significant change in circumstances such as an increase or decrease in a parent's income, a change in custody arrangements, or a change in the child's needs. It is not automatically fixed until the child reaches the age of majority.

Understanding the factual basis and intent behind the Florida Child Support Calculator form can lead to clearer expectations and reduce conflict during the child support determination process.

Key takeaways

When you're tasked with filling out the Florida Child Support Guidelines Worksheet, known as Form 12.902(e), it's because child support is being requested in your legal case.

Ensure to complete this worksheet accurately, utilizing black ink for printing or typing, to facilitate the calculation of child support. This task is especially crucial if you're aware of the other party's income, as it helps in finalizing the financial aspects concerning child support.

The guidelines necessitate you file the original worksheet with the clerk of the circuit court in the county where the case is filed. Retaining a copy for your records is also advised, providing a personal backup of the filed documentation.

After filling out the form, it's mandatory to serve a copy to the opposite party. This process must adhere to the Florida Rule of Judicial Administration 2.516, ensuring all parties are rightfully informed.

For current and accurate calculations, verifying that you're using the most recent version of the child support guidelines chart is essential. The chart lists guideline amounts based on the number of children and the combined income of the parents.

When preparing the worksheet, converting your income and expense figures to monthly amounts may be necessary for accuracy. This involves specific calculations, depending on the frequency of your payments.

In cases where an amount different from the guideline is sought, completing and attaching a Motion to Deviate from Child Support Guidelines is required. This step offers a formal request for the court's consideration of an adjusted support amount.

The assistance from a nonlawyer in filling out the forms mandates that they provide you with a Disclosure from Nonlawyer before helping. They must also include their contact details on the last page of every form they help you complete, ensuring transparency and accountability.

Persons fearing for their safety due to being victims of various forms of violence or harassment have the option not to disclose their address information. Instead, they can file a request for Confidential Filing of Address to protect their location details.

Always seek the latest chart updates and legal criteria for child support calculations in Florida. These guidelines are periodically revised, meaning staying informed through reliable resources is crucial for accurate and compliant form completion.

Popular PDF Documents

Court Florida - Prepare to meet the burden of proof in civil contempt or enforcement proceedings by familiarizing yourself with the Florida Supreme Court Approved Form 12.960.

State of Florida School Entry Health Exam - Simplifies access to critical health information, streamlining school health administration.