Fill Out a Valid Florida F 1120 Template

The Florida F-1120 form, serving as the backbone for corporate income and franchise tax returns within the state, encapsulates the financial obligations of corporations operating under Florida's jurisdiction. This form meticulously details the computation of Florida's net income, integrating both federal taxable income adjustments and state-specific modifications. The inclusion of deductions, credits, and exemptions further complicates the tax computation process, requiring comprehensive documentation, such as the attachment of federal returns and various schedules that address specific areas of income and tax adjustments. With its rigorous requirements, including the necessity for handwritten or typed completion in black ink, the Florida F-1120 form underlines the state's commitment to precise and equitable tax collection from its corporate citizens. The form's structured layout aims to streamline the reporting process, facilitating the accurate calculation of the corporate income/franchise tax due, while also providing for the inclusion of penalties, payments, and credits related to estimated tax payments, overpayments, and various credits against the tax. It underscores the important relationship between federal taxable income and its adjustments for Florida's tax purposes, ensuring businesses contribute their fair share to state revenues.

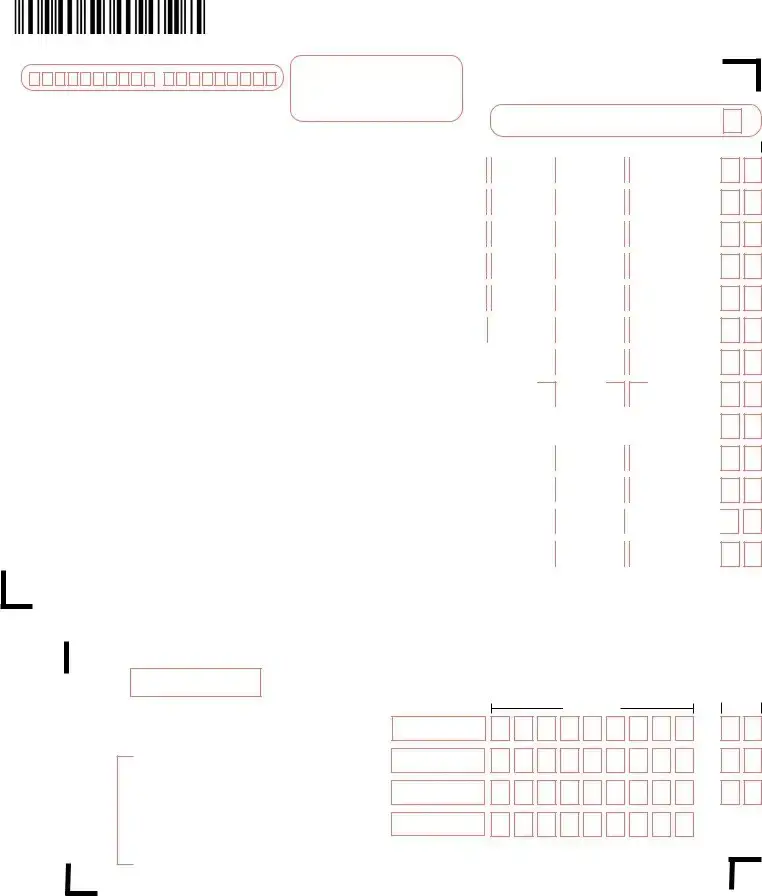

Document Preview Example

Florida Corporate Income/Franchise Tax Return |

|

|

R. 01/23 |

|

Rule |

|

Effective 01/23 |

Name |

Page 1 of 6 |

|

|

Address |

|

City/State/ZIP |

|

|

|

Use black ink. Example A - Handwritten Example B - Typed |

For calendar year 2015 or tax year |

|

|

|

|

|

|

|

|

Check here if any changes have been made to |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0123456789 |

|

|

|

|

|

|

|

|

name or address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

0 1 2 3 4 5 6 7 8 9 |

|

|

beginning _________________, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ending ________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year end date _ _________________ |

|

|

|

|

|

DOR use |

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Federal |

|

Employer Identification Number (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Florida Net Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

1. |

Federal taxable income (see instructions). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||

|

|

Check here |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Attach pages |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

2. |

State income taxes deducted in computing federal taxable income Check here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

2. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

(attach schedule) |

|

|

|

|

|

|

|

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

Additions to federal taxable income (from Schedule I) |

Check here |

|

3. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. |

Total of Lines 1, 2, and 3 |

|

|

|

|

|

|

|

|

|

Check here |

|

4. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

. |

|

|||||||||||||||||||||||||||||||||||||||||||||||

5. |

Subtractions from federal taxable income (from Schedule II) |

Check here |

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

6. |

Adjusted federal income (Line 4 minus Line 5) |

|

Check here |

|

6. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7. |

Florida portion of adjusted federal income (see instructions) |

Check here |

|

|

|

|

|

7. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

8. |

Nonbusiness income allocated to Florida (from Schedule R) |

Check here |

|

|

|

|

|

8. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

9. |

|

|

|

exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. |

Florida net income (Line 7 plus Line 8 minus Line 9) |

|

|

|

|

|

|

|

10. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Tax due: 5.5% of Line 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||

12. |

Credits against the tax (from Schedule V) |

|

|

|

|

|

|

|

12. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|||

13. |

Total corporate income/franchise tax due (Line 11 minus Line 12) |

|

|

|

|

|

|

13. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Cents

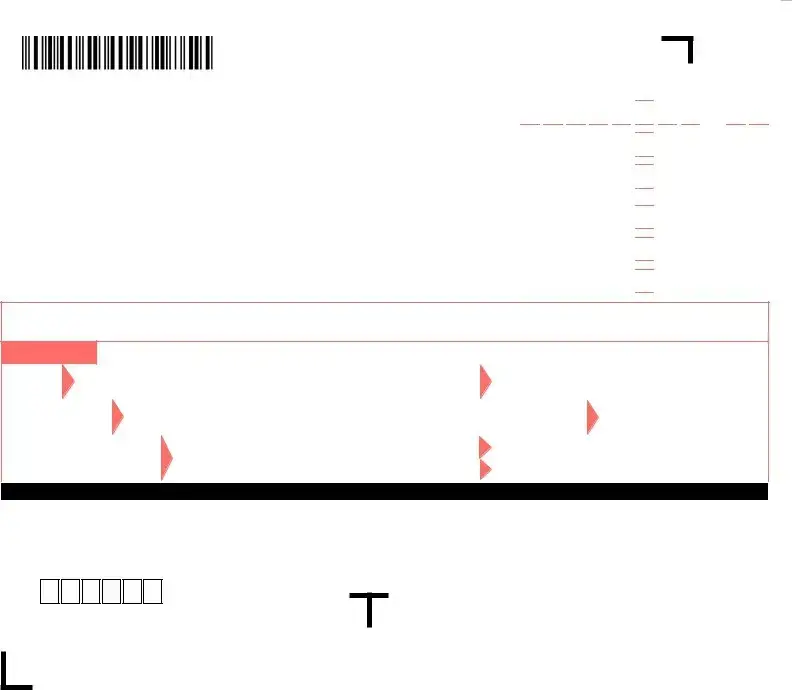

Payment Coupon for Florida Corporate Income Tax Return |

Do not detach coupon. |

||

|

To ensure proper credit to your account, enclose your check with tax return when mailing. |

R. 01/23 |

|

|

|||

|

|

||

ENDINGYEAR M  M

M  D

D  D

D  Y

Y  Y

Y

Enter name and address, if not

Name

Address

City/St

ZIP

If 6/30 year end, return is due 1st day of the 4th month after the close of the taxable year, otherwise return is due 1st day of the 5th month after the close of the taxable year.

|

US DOLLARS |

, |

CENTS |

|

Total amount due |

, |

. |

||

|

|

|

||

from Line 17 |

, |

, |

. |

|

Total credit |

||||

|

|

|

||

from Line 18 |

, |

, |

. |

|

Total refund |

||||

|

|

|

||

from Line 19 |

|

|

|

|

FEIN |

|

|

|

|

|

|

|||

Enter EIN if not |

|

|

|

|

9100 0 20229999 0002005037 5 3999999999 0000 2

R.01/23 Page 2 of 6

14. |

a) Penalty: |

b) Other____________________ |

|

||

|

c) Interest: |

d) Other____________________ Line 14 Total u 14. |

|||

15. |

Total of Lines 13 and 14 |

|

|

15. |

|

|

|

|

|

|

|

16. |

Payment credits: Estimated tax payments |

16a |

$ |

|

|

|

|

|

|

|

|

|

Tentative tax payment |

16b |

$ |

16 |

|

|

|

|

|

||

17. |

Total amount due: Subtract Line 16 from Line 15. If positive, enter amount |

|

|||

|

due here. If the amount is negative (overpayment), |

|

|

||

|

enter on Line 18 and/or Line 19 |

|

|

17. |

|

18. |

Credit: Enter amount of overpayment credited to next year’s estimated tax |

|

|||

|

here |

|

|

18. |

|

19. |

Refund: Enter amount of overpayment to be refunded here |

19. |

|||

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.

This return is considered incomplete unless a copy of the federal return is attached.

If your return is not signed, or improperly signed and verified, it will be subject to a penalty. The statute of limitations will not start until your return

is properly signed and verified. Your return must be completed in its entirety.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign here |

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of officer (must be an original signature) |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

Preparer |

|

|

Preparer’s |

|||||||||||

Paid |

|

check if self- |

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

||

signature |

Date |

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

preparers |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

Firm’s name (or yours |

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and address |

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Taxpayers Must Answer Questions A Through L Below — See Instructions

A.State of incorporation:_______________________________________________________________

B.Florida Secretary of State document number:__________________________________________

C. Florida consolidated return? |

YES q NO q |

D.q Initial return q Final return (final federal return filed)

E.Principal Business Activity Code (as pertains to Florida)

F.A Florida extension of time was timely filed? YES q NO q

Name of corporation: _______________________________________________

H.Location of corporate books:____________________________________________________________

City: __________________________________________ State: ______________ ZIP: ________________

I.Taxpayer is a member of a Florida partnership or joint venture? YES q NO q

J.Enter date of latest IRS audit: ______________

a)List years examined: ____________

K.Contact person concerning this return: _ __________________________________________________

a)Contact person telephone number: (______ )_____________________________________________

b)Contact person email address:_________________________________________________________

L.Type of federal return filed q1120 q1120S or __________________

Where to Send Payments and Returns

Make check payable to and mail with return to: Florida Department of Revenue

5050 W Tennessee Street

Tallahassee FL

If you are requesting a refund (Line 19), send your return to: Florida Department of Revenue

PO Box 6440

Tallahassee FL

Remember:

üMake your check payable to the Florida Department of Revenue.

üWrite your FEIN on your check.

üSign your check and return.

ü

ü

Attach a copy of your federal return.

Attach a copy of your Florida Form

R. 01/23

Page 3 of 6

NAME |

FEIN |

TAXABLE YEAR ENDING |

|

|

|

Schedule I — Additions and/or Adjustments to Federal Taxable Income |

|

|

1. |

Interest excluded from federal taxable income (see instructions) |

1. |

|

|

|

2. |

Undistributed net |

2. |

|

|

|

3. |

Net operating loss deduction (attach schedule) |

3. |

|

|

|

4. |

Net capital loss carryover (attach schedule) |

4. |

|

|

|

5. |

Excess charitable contribution carryover (attach schedule) |

5. |

|

|

|

6. |

Employee benefit plan contribution carryover (attach schedule) |

6. |

|

|

|

7. |

Enterprise zone jobs credit (Florida Form |

7. |

|

|

|

8. |

Ad valorem taxes allowable as an enterprise zone property tax credit (Florida Form |

8. |

|

|

|

9. |

Guaranty association assessment(s) credit |

9. |

|

|

|

10. |

Rural and/or urban |

10. |

|

|

|

11. |

State housing tax credit |

11. |

|

|

|

12. |

Florida tax credit scholarship program credit (credit for contributions to nonprofit |

12. |

|

|

|

13. |

New worlds reading initiative credit |

13. |

|

|

|

14. |

Strong families tax credit (credit for contributions to eligible charitable organizations) |

14. |

|

|

|

15. |

New markets tax credit |

15. |

|

|

|

16. |

Entertainment industry tax credit |

16. |

|

|

|

17. |

Research and development tax credit |

17. |

|

|

|

18. |

Energy economic zone tax credit |

18. |

|

|

|

19. |

s.168(k), IRC, special bonus depreciation |

19. |

|

|

|

20. |

Depreciation of qualified improvement property (see instructions) |

20. |

|

|

|

21. |

Expenses for business meals provided by a restaurant (see instructions) |

21. |

|

|

|

22. |

Film, television, and live theatrical production expenses (see instructions) |

22. |

|

|

|

23. |

Internship tax credit |

23. |

|

|

|

24. |

Other additions (attach schedule) |

24. |

|

|

|

25. |

Total Lines 1 through 24. Enter total on this line and on Page 1, Line 3. |

25. |

|

|

|

Schedule II — Subtractions from Federal Taxable Income

1.Gross foreign source income less attributable expenses

(a) Enter s. 78, IRC, income |

$ _________________________ |

|

(b) plus s. 862, IRC, dividends |

$ _________________________ |

|

(c) plus s. 951A, IRC, income |

$ _________________________ |

1. |

(d) less direct and indirect expenses |

|

Total u |

and related amounts deducted |

|

|

under s. 250, IRC |

$ _________________________ |

|

2.Gross subpart F income less attributable expenses

|

(a) Enter s. 951, IRC, subpart F income $ _______________________ |

2. |

|

|

(b) less direct and indirect expenses $ _______________________ |

Total u |

|

|

|

||

Note: Taxpayers doing business outside Florida enter zero on Lines 3 through 6, and complete Schedule IV. |

3. |

||

3. |

Florida net operating loss carryover deduction (see instructions) |

||

|

|||

|

|

|

|

4. |

Florida net capital loss carryover deduction (see instructions) |

4. |

|

|

|

|

|

5. |

Florida excess charitable contribution carryover (see instructions) |

5. |

|

|

|

|

|

6. |

Florida employee benefit plan contribution carryover (see instructions) |

6. |

|

|

|

|

|

7. |

Nonbusiness income (from Schedule R, Line 3) |

7. |

|

|

|

|

|

8. |

Eligible net income of an international banking facility (see instructions) |

8. |

|

|

|

|

|

9. |

s. 168(k), IRC, special bonus depreciation (see instructions) |

9. |

|

|

|

|

|

10. |

Depreciation of qualified improvement property (see instructions) |

10. |

|

|

|

|

|

11. |

Film, television, and live theatrical production expenses (see instructions) |

11. |

|

|

|

|

|

12. |

Other subtractions (attach schedule) |

12. |

|

|

|

|

|

13. |

Total Lines 1 through 12. Enter total on this line and on Page 1, Line 5. |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/23 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 6 |

||

NAME |

|

|

|

|

|

FEIN |

|

|

|

|

|

|

TAXABLE YEAR ENDING |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Schedule III — Apportionment of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

(c) |

|

|

|

|

(d) |

|

|

|

(e) |

|

|||||

|

|

WITHIN FLORIDA |

|

TOTAL EVERYWHERE |

Col. (a) ÷ Col. (b) |

|

|

|

|

Weight |

|

|

|

Weighted Factors |

|

|||||||

|

|

(Numerator) |

|

(Denominator) |

|

|

Rounded to Six Decimal |

|

If any factor in Column (b) is zero, |

|

Rounded to Six Decimal |

|

||||||||||

|

|

|

|

|

|

|

|

Places |

|

|

see note on Page 9 of the instructions. |

|

Places |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Property (Schedule |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Payroll |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Sales (Schedule |

|

|

|

|

|

|

|

|

|

|

|

X 50% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Apportionment fraction (Sum of Lines 1, 2, and 3, Column [e]). Enter here and on Schedule IV, Line 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

WITHIN FLORIDA |

|

|

|

|

|

|

TOTAL EVERYWHERE |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

a. Beginning of year |

|

b. End of year |

|

c. Beginning of year |

|

d. End of year |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Inventories of raw material, work in process, finished |

goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Buildings and other depreciable assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Land owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Other tangible and intangible (financial org. only) assets (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Total (Lines 1 through 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Average value of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Add Line 5, Columns (a) and (b) and divide by 2 (for within Florida)........... 6a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

b. Add Line 5, Columns (c) and (d) and divide by 2 (for total Everywhere) |

|

|

|

|

|

|

|

|

6b. |

|

|

|

|

|

|

|

|||||

7. |

Rented property (8 times net annual rent) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Rented property in Florida |

|

|

7a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Rented property Everywhere |

|

|

|

|

|

|

|

|

|

|

7b. |

|

|

|

|

|

|

|

|||

8. |

Total (Lines 6 and 7). Enter on Line 1, Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

a. Enter Lines 6a. plus 7a. and also enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Column (a) for total average property in Florida |

|

|

8a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Enter Lines 6b. plus 7b. and also enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Column (b) for total average property Everywhere |

|

|

|

|

|

|

|

|

|

|

8b. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

(b) |

|

||||||

|

|

|

|

|

|

|

|

|

TOTAL WITHIN FLORIDA |

|

|

TOTAL EVERYWHERE |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(Numerator) |

|

|

|

(Denominator) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Sales (gross receipts) |

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

|

|

|

|

||||

2. |

Sales delivered or shipped to Florida purchasers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Other gross receipts (rents, royalties, interest, etc. when applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

TOTAL SALES (Enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(a) WITHIN FLORIDA |

|

|

(b) TOTAL EVERYWHERE |

|

(c) FLORIDA Fraction ([a] ÷ [b]) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rounded to Six Decimal Places |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Insurance companies (attach copy of Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Transportation services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Schedule IV — Computation of Florida Portion of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

||||||||||||

1. |

Apportionable adjusted federal income from Page 1, Line 6 |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. |

Florida apportionment fraction (Schedule |

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3. |

Tentative apportioned adjusted federal income (multiply Line 1 by Line 2) |

|

|

|

|

|

|

3. |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4. |

Net operating loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

4. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

5. |

Net capital loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

5. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

6. |

Excess charitable contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

6. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

Employee benefit plan contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

7. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. |

Total carryovers apportioned to Florida (add Lines 4 through 7) |

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

9. |

Adjusted federal income apportioned to Florida (Line 3 less Line 8; see instructions) |

|

|

|

|

9. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/23

Page 5 of 6

NAME |

|

FEIN |

TAXABLE YEAR ENDING |

|

||||

|

|

|

|

|

|

|||

|

Schedule V — Credits Against the Corporate Income/Franchise Tax |

|

|

|

|

|||

|

1. |

|

Florida health maintenance organization consumer assistance assessment credit (attach assessment notice) |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Capital investment tax credit (attach certification letter) |

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

Enterprise zone jobs credit (from Florida Form |

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

Community contribution tax credit (attach certification letter) |

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

Enterprise zone property tax credit (from Florida Form |

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

Rural job tax credit (attach certification letter) |

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

7. |

|

Urban |

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

Hazardous waste facility tax credit |

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

9. |

|

Florida alternative minimum tax (AMT) credit |

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

10. |

|

Contaminated site rehabilitation tax credit (voluntary cleanup tax credit) (attach tax credit certificate) |

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

State housing tax credit (attach certification letter) |

|

|

|

11. |

|

|

|

|

|

|

|

|

||

|

12. |

|

Florida tax credit scholarship program credit (credit for contributions to nonprofit |

|

12. |

|

||

|

|

|

|

|

|

|

|

|

|

13. |

New worlds reading initiative credit (attach certificate) |

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

Strong families tax credit (credit for contributions to eligible charitable organizations) (attach certificate) |

|

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

New markets tax credit |

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

16. |

|

Entertainment industry tax credit |

|

|

|

16. |

|

|

|

|

|

|

|

|

|

|

|

17. |

|

Research and development tax credit |

|

|

|

17. |

|

|

|

|

|

|

|

|

|

|

|

18. |

|

Energy economic zone tax credit |

|

|

|

18. |

|

|

|

|

|

|

|

|

|

|

|

19. |

|

Internship tax credit |

|

|

|

19. |

|

|

|

|

|

|

|

|

|

|

|

20. |

|

Other credits (attach schedule) |

|

|

|

20. |

|

|

|

|

|

|

|

|

|

|

|

21. |

|

Total credits against the tax (sum of Lines 1 through 20 not to exceed the amount on Page 1, Line 11). |

|

|

21. |

|

|

|

|

|

Enter total credits on Page 1, Line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Schedule R — Nonbusiness Income |

|

|

|

|

|

||

|

Line 1. Nonbusiness income (loss) allocated to Florida |

|

|

|

|

|||

|

|

|

Type |

|

|

Amount |

|

|

_____________________________________ |

|

_____________________________________ |

|

|||||

_____________________________________ |

|

_____________________________________ |

|

|||||

_____________________________________ |

|

_____________________________________ |

|

|||||

|

|

|

Total allocated to Florida |

1. ___________________________________ |

|

|||

|

|

|

(Enter here and on Page 1, Line 8) |

|

|

|

|

|

|

Line 2. Nonbusiness income (loss) allocated elsewhere |

|

|

|

|

|||

|

|

|

Type |

State/country allocated to |

|

Amount |

|

|

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

|

|

|

Total allocated elsewhere |

2. ___________________________________ |

|

|||

|

Line 3. Total nonbusiness income |

|

|

|

|

|

||

|

|

|

Grand total. Total of Lines 1 and 2 |

3. ___________________________________ |

|

|||

(Enter here and on Schedule II, Line 7)

R. 01/23

Page 6 of 6

NAME |

FEIN |

TAXABLE YEAR ENDING |

Estimated Tax Worksheet For Taxable Years Beginning On or After January 1, 2023 |

||

1. Florida income expected in taxable year |

.................................................................................................... |

1. $ ________________ |

2.Florida exemption $50,000 (Members of a controlled group, see instructions on Page 15 of

|

Florida Form |

2. |

$ ________________ |

|

3. |

Estimated Florida net income (Line 1 less Line 2) |

3. |

$ ________________ |

|

4. |

Total Estimated Florida tax (5.5% of Line 3) |

$ _____________________________ |

|

|

|

Less: Credits against the tax |

$ _____________________________ |

4. |

$ ________________ |

5.Computation of installments:

Payment due dates and |

If 6/30 year end, last day of 4th month, |

|

payment amounts: |

otherwise last day of 5th month - Enter 0.25 of Line 4 |

5a.______________________ |

|

Last day of 6th month - Enter 0.25 of Line 4 |

5b.______________________ |

|

Last day of 9th month - Enter 0.25 of Line 4 |

5c.______________________ |

|

Last day of taxable year - Enter 0.25 of Line 4 |

5d.______________________ |

NOTE: If your estimated tax should change during the year, you may use the amended computation below to determine the amended amounts to be entered on the declaration (Florida Form

1. Amended estimated tax |

1. $ _______________ |

2.Less:

(a)Amount of overpayment from last year elected for credit

|

to estimated tax and applied to date |

2a. - $______________ |

|

|

(b) Payments made on estimated tax declaration (Florida Form |

2b. - $_____________ |

|

|

(c) Total of Lines 2(a) and 2(b) |

2c. |

$ _______________ |

3. |

Unpaid balance (Line 1 less Line 2(c)) |

3. |

$ _______________ |

4. |

Amount to be paid (Line 3 divided by number of remaining installments) |

4. |

$ _______________ |

References

The following documents were mentioned in this form and are incorporated by reference in the rules indicated below.

The forms are available online at floridarevenue.com/forms.

Form |

Underpayment of Estimated Tax on Florida |

Rule |

|

Corporate Income/Franchise Tax |

|

Form |

Florida Tentative Income/Franchise Tax Return |

Rule |

|

and Application for Extension of Time to File |

|

|

Return |

|

Form |

Florida Enterprise Zone Jobs Credit Certificate of |

Rule |

|

Eligibility for Corporate Income Tax |

|

Form |

Enterprise Zone Property Tax Credit |

Rule |

Form |

Instructions for Corporate Income/Franchise Tax Return |

Rule |

Form |

Declaration/Installment of Florida Estimated |

Rule |

|

Income/Franchise Tax |

|

Document Overview

| Fact Name | Description |

|---|---|

| Form Title | Florida Corporate Income/Franchise Tax Return F-1120 |

| Revision Date | R. 01/20 |

| Governing Rule | Rule 12C-1.051, F.A.C. |

| Implementation Date | Effective January 2020 |

| Writing Requirement | Must be completed in black ink; can be handwritten or typed |

| Attachment Requirement | A copy of the federal return must be attached for the submission to be considered complete |

| Signature Requirement | The form requires an original signature from an officer and, if applicable, a paid preparer to be valid |

Instructions on How to Fill Out Florida F 1120

Filling out the Florida Corporate Income/Franchise Tax Return, Form F-1120, is a straightforward process if you follow each step carefully. This tax form is used by corporations conducting business in Florida to report income and calculate their state tax liability. The form has several parts, including the calculation of Florida net income, apportionment if doing business outside Florida, and various schedules for credits and adjustments. Ensuring accuracy in filling out this form is crucial for complying with Florida's tax regulations.

Steps for Filling Out the Florida F-1120 Form- Begin with the taxpayer's information section: Enter the corporation's name, address, city, state, ZIP code, and the federal employer identification number (FEIN).

- Indicate the tax year by filling out the dates for the beginning and end of the tax year being reported.

- Under "Computation of Florida Net Income Tax," input the federal taxable income on Line 1. If there's a negative amount, check the box indicating this.

- For Line 2, state any income taxes deducted in the computation of federal taxable income. Attach a schedule if needed.

- Add additions to federal taxable income on Line 3 as calculated on Schedule I, checking the box if the value is negative.

- Calculate the total of Lines 1, 2, and 3, and enter this on Line 4. Check the box if this total is negative.

- Enter subtractions from federal taxable income on Line 5, as determined on Schedule II, again checking the box if the value is negative.

- Derived from the previous steps, Line 6 will show the adjusted federal income. A negative amount mark should be indicated if applicable.

- On Line 7, input the Florida portion of adjusted federal income. Consult the instructions if this is negative.

- Add any nonbusiness income allocated to Florida on Line 8. Check if the amount is negative.

- Line 9 is for the Florida exemption; consult the instructions for the exact exemption amount.

- Calculate Florida net income by adding Line 7 and Line 8 then subtracting Line 9; enter this total on Line 10.

- Complete the tax due on Line 11 by applying the current tax rate to the Florida net income.

- If applicable, list any credits against the tax on Line 12, as detailed on Schedule V.

- Add the total corporate income/franchise tax due, which is the sum of Lines 11 and 12, to Line 13.

- Review additional sections for penalties, payments, and overpayments, completing Lines 14 through 19 as required.

- Ensure to attach a copy of the federal return, as this is necessary for the completion of the Form F-1120.

- Finally, the form must be signed and dated by an officer of the corporation, and if prepared by someone other than the taxpayer, the preparer's information should also be included.

Remember, this form also requires completing and attaching relevant schedules for additions, subtractions, credits, and apportionment details if doing business outside Florida. Accurate completion and timely submission of this form, along with the necessary documentation, are critical in meeting Florida's tax obligations and avoiding any potential penalties for inaccuracies or late filings.

Listed Questions and Answers

What is the Florida F-1120 form?

The Florida F-1120 form is a tax document for corporations operating in Florida. It's used to report their income, calculate their tax liability, and submit the annual amount they owe for corporate income and franchise taxes.

Who needs to file the Florida F-1120 form?

Most corporations conducting business in Florida are required to file the F-1120 form. This includes entities incorporated in Florida and out-of-state corporations that do business, own property, or earn income within the state.

When is the Florida F-1120 due?