Fill Out a Valid Florida Rts 6 Template

In navigating the complexities of managing a workforce that spans multiple states, employers in Florida may find the Employer’s Reciprocal Coverage Election RTS-6, a critical tool. Orchestrated under the auspices of the Florida Administrative Code, this form enables employers to opt for coverage of certain employees under Florida's reemployment (formerly unemployment) tax laws, despite these individuals performing services across different jurisdictions. At its core, the RTS-6 form serves as a request from the employer to the Florida Department of Revenue to establish reciprocal coverage arrangements with other states where the employees might also qualify for unemployment benefits. It requires detailed information, including the employer's name and business nature, a comprehensive list of the employees to be covered by the election, and a rationale for their coverage under Florida law. Employers must also indicate their agreement to comply with the accompanying obligations, ensuring workers are informed of their coverage and that the arrangement does not adversely affect the unemployment compensation benefits they might be entitled to from other states. The approval process involves multiple steps, including submission to and acceptance by both the Florida Department of Revenue and the authorities in the other states involved. This layer of administrative procedure highlights the form’s importance in ensuring that workers who frequently cross state lines for their jobs do not fall through the cracks of the unemployment insurance system. Additionally, maintaining strict confidentiality over social security numbers and adhering to specific procedural requirements underscore the state’s commitment to privacy and orderly tax administration.

Document Preview Example

Employer’s Reciprocal Coverage Election

R. 01/13

Rule

|

Reemployment Tax Account Number |

|||||||||||||

Employer’s Name: _______________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above employer hereby elects, subject to approval by the agencies involved, to cover certain individuals (those customarily performing services in more than one jurisdiction) named below and on any attached form, under the reemployment tax (formerly unemployment tax) law of Florida.

1.The employer accordingly requests the state of Florida, Department of Revenue to enter into a reciprocal coverage arrangement to that effect, with each of the following other “interested jurisdictions” (in which the individuals named under Item 2 perform some services for the employer, and under whose unemployment compensation laws they might otherwise be covered):

State

% Of Service

State

% Of Service

(If more space is required, use and attach Form

2. List employees covered by this election:

Employee’s Name

Social Security |

Employee’s Legal |

Number |

Residence |

|

|

Basis for Election in Florida

a)Does some work in Florida

b)Residence in Florida

c)Related to a place of business in Florida

(If more space is required, use and attach Form

3.Nature of employer’s business. _________________________________________________________________________

4.The employer has a place of business in the states listed above. ____________________________________________

5.Nature of work to be performed by the individual(s) listed under Item 2. ______________________________________

6.Employer’s reason for requesting coverage in Florida. _____________________________________________________

7.The employer requests that this election become effective as of the beginning of a calendar quarter, namely as of ______________________________________

www.mylorida.com/dor

R. 01/13

Page 2

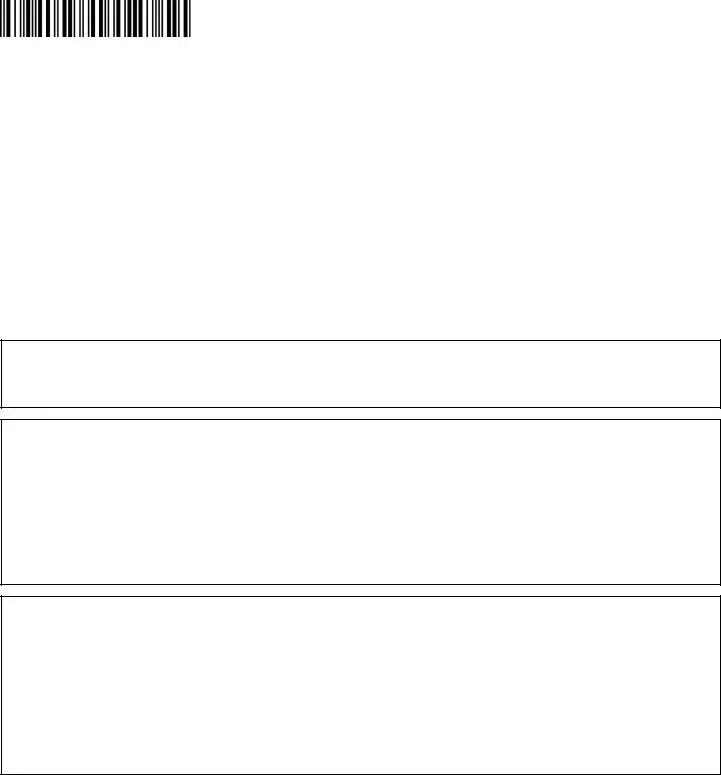

ELECTION (continued)

8.This election, if approved, shall remain operative, as to the individuals listed herewith, until terminated in accordance with the currently applicable regulations of the Florida Department of Revenue.

9.The employer hereby agrees to give each individual covered by this election a notice thereof, promptly after its approval, on a form to be supplied by the Florida Department of Revenue, and to ile copies thereof with said agency.

10.The employer hereby agrees to comply with any requirements applicable to this election under the Florida Department of Revenue.

11.To prevent this election from denying reemployment assistance/unemployment compensation coverage to workers not listed hereon, the employer hereby agrees with each interested jurisdiction approving this election that it may count the workers covered by this election, and their wages, as if this election did not apply, for the purpose

of determining whether the employer is covered by the law of such jurisdiction and whether any other workers employed by him are covered by said law.

SIGNED, for the employer by: ______________________________________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVAL by the state of Florida, Department of Revenue

The foregoing election is hereby approved, in accordance with the applicable regulations, as submitted by the elect- ing employer.

APPROVED for the state of Florida, Department of Revenue.

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVED by the interested jurisdiction of _________________________________________________________________

The foregoing is similarly approved.

Name of Agency: ______________________________________

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

NOTE: The employer should submit two (2) signed copies for each jurisdiction listed under item 1, plus two (2) additional copies. All copies should be sent to the state of Florida, Department of Revenue, P.O. Box 6510, Tallahassee, FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are conidential under sections 213.053

and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.mylorida.com/dor and select “Privacy Notice” for more

information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

www.mylorida.com/dor

Document Overview

| Fact | Detail |

|---|---|

| Form Name | Employer’s Reciprocal Coverage Election RTS-6 |

| Revision Date | January 2013 (R. 01/13) |

| Governing Rule | Rule 73B-10.037 Florida Administrative Code |

| Purpose | To request reciprocal coverage arrangement for employees working in multiple jurisdictions under Florida's reemployment tax law. |

| Eligibility Criteria | Employers with employees performing services in more than one jurisdiction. |

| Application Information Required | Employer’s name, Reemployment Tax Account Number, list of employees, and justification for requesting coverage in Florida. |

| Approval Process | Subject to approval by the Florida Department of Revenue and the other interested jurisdictions. |

| Notice Requirement | Employer must notify each individual covered by this election upon its approval. |

| Election Terms | This election remains operative until terminated in accordance with Florida Department of Revenue regulations. |

| Confidentiality | SSNs obtained are confidential under sections 213.053 and 119.071, Florida Statutes. |

Instructions on How to Fill Out Florida Rts 6

After determining the need to cover certain employees under the Florida reemployment tax law, due to their work across multiple jurisdictions, an employer should complete the Employer’s Reciprocal Coverage Election (RTS-6) form. This detailed form requires careful attention to ensure that all relevant employees are listed and that the appropriate jurisdictions are documented. The filling process represents the official request to the Florida Department of Revenue to consider these employees under Florida's coverage instead of the states where they occasionally work. Here is a straightforward guide on how to properly fill out the RTS-6 form.

- Enter the Reemployment Tax Account Number: At the top of the form, specify your business's unique reemployment tax account number.

- Provide the Employer's Name: Write the legal name of your business clearly. This should match the name associated with your reemployment tax account number.

- Identify Interested Jurisdictions: List all states where the named employees perform services. Alongside each state, denote the percentage of service performed in that jurisdiction. If there’s not enough space, attach Form RTS-6A to include additional states.

- List Employees Covered by This Election: Under item 2, include the full name, social security number, and legal residence of each employee to be covered under this election. Also, indicate the basis for election in Florida (work, residence, related business location). Add Form RTS-6A if you need more space.

- Describe the Nature of Your Business: Under item 3, provide a brief but comprehensive description of your business operations.

- Confirm Presence of a Business Place: In item 4, state if your business has a place of business in the states listed in item 1, and describe it briefly.

- Nature of Work Performed: Item 5 requires a description of the work your listed employees perform. Be specific to clarify the services they provide across jurisdictions.

Articulate the Reason for Requesting Florida Coverage: Item 6 asks for the rationale behind choosing Florida for reemployment coverage over the other states. - Indicate the Effective Date of Election: Specify the date from which this election should become operative, ideally aligning with the start of a calendar quarter in item 7.

- Confirmation of Ongoing Operation: In item 8, acknowledge that this election remains effective until officially terminated based on Florida's regulations.

- Agreement to Notify Employees: Item 9 commits the employer to inform each covered employee about this election and to file the necessary notices with the Florida Department of Revenue.

- Compliance Statement: By filling item 10, the employer agrees to adhere to all requirements related to this election as laid out by Florida's Department of Revenue.

- Worker Coverage Agreement: In item 11, affirm the understanding that this election does not exclude other workers from reemployment assistance. It’s an agreement that all workers, whether listed or not, will be considered under the jurisdiction’s laws for coverage purposes.

- Signature and Date: In the designated area, the form must be signed and dated by an authorized representative of the employer, including their title.

Once completed, it’s crucial to submit two signed copies of this form for each jurisdiction mentioned, plus two additional copies to the state of Florida, Department of Revenue. The address is provided within the form. Remember, the application process involves review and approval from each jurisdiction listed, so keep copies for your records and await notification from the Florida Department of Revenue regarding the status of your election. This step ensures your employees are properly covered across state lines under Florida’s reemployment tax law.

Listed Questions and Answers

What is the purpose of the Florida RTS-6 form?

The Florida RTS-6 form, also known as the Employer’s Reciprocal Coverage Election, is designed for employers to request coverage under Florida’s reemployment tax law for certain employees. These employees traditionally work across more than one jurisdiction and, without this form, might be covered under a different state’s unemployment compensation laws. In essence, it allows an employer to consolidate reemployment tax responsibilities within Florida for employees working in multiple states.

Who needs to fill out the RTS-6 form?

Employers who have workers performing services in multiple jurisdictions—including Florida—and who wish to elect Florida as the state for reemployment tax purposes need to complete the RTS-6 form. This is particularly relevant for businesses with mobile employees who might otherwise be subject to varying state unemployment laws.

How does an employer submit the RTS-6 form?

To submit the RTS-6 form, employers must fill it out and send two signed copies for each jurisdiction listed in item 1 of the form, plus two additional copies, to the State of Florida, Department of Revenue at the specified P.O. Box in Tallahassee, FL. Additional copies are forwarded to each "interested jurisdiction" for approval or disapproval, and the Florida Department of Revenue notifies the employer of the final decision.

What happens if the RTS-6 form is approved?

Once the RTS-6 form is approved, the election becomes effective from the beginning of a calendar quarter, as specified by the employer in the form. The election remains in effect for the employees listed until it is terminated in accordance with Florida Department of Revenue regulations. The employer is also required to notify each covered individual and file copies of the notice with the Florida Department of Revenue.

Can an employer cover additional employees after the initial RTS-6 form submission?

Yes, if an employer wishes to cover additional employees under the same reciprocal coverage arrangement after the initial submission and approval, they must use and attach Form RTS-6A. This allows for the inclusion of new employees or the modification of existing employee information under the established election.

Common mistakes

When completing the Florida RTS-6 form, commonly known as the Employer’s Reciprocal Coverage Election, individuals often make mistakes that can lead to delays or issues with the processing of their application. Below are seven common mistakes made during this process:

- Not providing complete information about the employer's name and Reemployment Tax Account Number at the top of the form. This basic yet crucial information identifies the employer within the state's tax system.

- Failing to list all states under Item 1 where the individuals perform services for the employer. It's essential to mention every state, as this determines the jurisdictions involved in the reciprocal coverage.

- Incorrectly listing or omitting the Social Security numbers and legal residence of employees under Item 2. Accurate Social Security numbers are crucial for tax administration purposes and to correctly identify each employee.

- Omitting details about the nature of the employer's business under Item 3. This information helps in understanding the business operations and the context of the coverage election.

- Not specifying the nature of work to be performed by the individuals listed under Item 2, or providing vague descriptions. Clear descriptions help in determining the applicability of the coverage.

- Forgetting to mention the employer's reason for requesting coverage in Florida under Item 6. This rationale is important for the Department of Revenue to understand the motivation behind the election.

- Not signing and dating the form at the end or providing incomplete details about the authorizing individual’s title and the date of submission. The signature, title, and date confirm the employer’s agreement to the terms and ensure the form is officially submitted.

It is imperative for employers to review the form thoroughly before submission, ensuring that all sections are accurately filled out to avoid unnecessary processing delays or complications. For additional guidance, accessing detailed instructions or seeking assistance from a professional can be beneficial.

Documents used along the form

When businesses navigate the complexities of tax and employment laws, the Florida RTS-6 form serves as a crucial document for employers seeking reciprocal coverage elections for their employees who work across state lines. However, to ensure comprehensive compliance and to efficiently manage their workforce, employers often need to familiarize themselves with additional forms and documents. Below is a list of documents that are frequently used alongside the Florida RTS-6 form, each playing an essential role in the facilitation of cross-state employee management and tax compliance.

- RTS-6A Form: An extension of the RTS-6 Form, used when additional space is needed to list employees or interested jurisdictions for reciprocal coverage arrangements. It ensures that all necessary information is captured, especially when dealing with larger workforces.

- UCS-6A Form: Previously known as the RTS-6A, this form serves a similar purpose in providing additional space for listing employees under reciprocal coverage elections. It remains a vital document for employers with extensive staffing needs across multiple states.

- RTS-3 Form: Used by employers to report and pay reemployment taxes in Florida. It is critical for maintaining compliance with state laws regarding unemployment contributions. This form helps ensure that the appropriate taxes are being paid for all employees, including those covered under reciprocal agreements.

- AWI-UCS-5 Form: An Unemployment Compensation Tax Rate Notice received from the Florida Department of Revenue. It informs employers of their current tax rate, which can be influenced by reciprocal coverage elections and is important for accurate financial planning and reporting.

- RTS-1 Form: Required for registering a business with the Florida Department of Revenue for reemployment tax purposes. Initial registration is a prerequisite before an employer can file an RTS-6 form and is foundational for establishing a business's eligibility to operate and employ within the state.

- Form DR-1: Used for opening a commercial tax account in Florida, this form is related to the registration process for various state taxes, including sales and use tax, which might indirectly impact employers considering reciprocal coverage for their employees.

- RTS-2 Form: Employers use this document to update their account information, such as changes in address, ownership, or business status. Keeping information current is vital for receiving timely communications from the Florida Department of Revenue regarding the RTS-6 form and other tax obligations.

- SS-4 Form: Issued by the IRS, this form is used to apply for an Employer Identification Number (EIN). While not specific to Florida, an EIN is necessary for businesses across the United States, including those applying for reciprocal coverage through Florida’s RTS-6 form, highlighting the interconnected nature of federal and state tax requirements.

Understanding and utilizing these forms in conjunction with the Florida RTS-6 form can significantly streamline the process of ensuring proper tax and employment practices for businesses operating across state lines. It's not just about fulfilling legal obligations; it’s also about adopting a proactive approach to managing a diverse and often geographically dispersed workforce. By being informed and prepared, employers can navigate these complexities with greater confidence and efficiency.

Similar forms

The Florida RTS-6 form, known as the Employer’s Reciprocal Coverage Election, shares several similarities with other documents that are integral to managing employment and taxation issues across different states. These similarities are not based on the content alone but also on the function and purpose of the forms. Even though each form serves a unique purpose, their underlying goal to streamline and clarify tax and employment reporting requirements makes them somewhat interconnected. Below are some of the documents that are similar to the Florida RTS-6 form in various aspects:

Form UC-1, Florida Unemployment Tax Registration Form - Much like the RTS-6, Form UC-1 is also used in the realm of employment taxation, specifically for registering a business with the Florida Department of Revenue for unemployment tax purposes. While RTS-6 is focused on establishing a reciprocal coverage arrangement for employees working in multiple jurisdictions, UC-1 is the initial step towards creating an unemployment tax account for a business. Both forms are essential for ensuring compliance with Florida’s unemployment tax laws, thereby assisting employers in managing their tax liabilities and obligations efficiently.

Form RTS-3, Florida Reemployment Tax Field Audit Report - This form shares a functional resemblance with the RTS-6 as it deals with the outcomes of a reemployment tax audit. The RTS-3 is used to report the findings of a field audit conducted by the Florida Department of Revenue. The commonality between RTS-6 and RTS-3 lies in their focus on the reemployment (unemployment) tax aspect, though from different angles. While RTS-6 enables employers to cover employees across states under Florida's reemployment tax law, RTS-3 facilitates the review and correction of an employer's tax records. Both contribute to a transparent and compliant tax reporting environment.

Form UCS-6A, Reciprocal Coverage Amendment - The RTS-6 form mentions Form RTS-6A (formerly UCS-6A) as an attachment for situations requiring additional space. This linkage highlights a direct similarity because RTS-6A serves as an extension of RTS-6, enabling employers to list more employees or jurisdictions involved in the reciprocal coverage election. Though technically two distinct forms, their purposes are intertwined, with RTS-6A acting as a supplemental document to ensure comprehensive coverage and accurate reporting as per the reciprocal arrangement established by RTS-6.

Each of these forms plays a pivotal role in the ecosystem of employment and taxation documentation within the state of Florida. While they serve specific purposes, their collective aim is to facilitate clear, compliant, and efficient tax and employment reporting and management for businesses operating across state lines.

Dos and Don'ts

When filling out the Florida RTS-6 form, careful attention to detail and adherence to the requirements can streamline the process. This document is crucial for employers who wish to elect reciprocal coverage for their employees, ensuring they are covered under Florida's reemployment tax laws, even when performing services in multiple jurisdictions. Here are the dos and don'ts to keep in mind:

Do:- Verify all details: Ensure that the employer's name, reemployment tax account number, and all other provided information are accurate and match the records. Inaccuracies can lead to processing delays or rejections.

- List all employees accurately: Include every employee who should be covered by this election, providing their full names, social security numbers, and the basis for their election in Florida accurately.

- Attach additional forms if necessary: If the space provided on the RTS-6 form is insufficient, use and attach Form RTS-6A for additional entries. This ensures all relevant information is captured and submitted together.

- Sign and date the form: Confirm that the form is signed and dated by an authorized representative of the employer. An unsigned form is invalid and will not be processed.

- Overlook the instructions: Failing to follow the detailed instructions provided with the form can result in incorrect filling, leading to processing delays. Each section has specific requirements that must be met.

- Miss the submission deadline: Ensure the form is submitted in a timely manner, especially if you have specific dates by which you want the election to become effective. Late submissions may not be processed as expected.

- Forget to notify employees: Once the election is approved, it is the employer's responsibility to inform each affected employee. Neglecting this step can lead to confusion and potential complaints from employees.

- Disregard jurisdiction requirements: When listing jurisdictions under which employees perform services, ensure that all relevant jurisdictions are accurately named and addressed. Omitting jurisdictions or providing incorrect information might invalidate the election for those areas.

Adhering to these guidelines will help ensure that the RTS-6 form submission is smooth and free from complications. It's important for employers to be thorough and precise in this process to facilitate proper coverage for their employees under Florida's reemployment laws.

Misconceptions

When it comes to the Florida RTS-6 form, a range of misconceptions can mislead employers and employees alike. By highlighting and correcting these misunderstandings, individuals can ensure they are better informed about their obligations and rights under this provision.

- Misconception 1: The RTS-6 form is only for large businesses. This misunderstanding might stem from the complexity typically associated with tax and legal documents. However, the form applies to any employer that has employees performing services in more than one jurisdiction and chooses to cover these employees under the Florida Reemployment Tax Law. It's not the size of the business but the nature of the work and the geographical diversity of the workforce that dictates the need for this form.

- Misconception 2: Submitting the RTS-6 form automatically approves coverage. The reality is that submitting the form is merely a request for the reciprocal coverage election. Approval must come from the Florida Department of Revenue and any other interested jurisdiction where the employees perform some work. The process entails evaluation and can result in either approval or denial based on compliance with specific requirements.

- Misconception 3: Once approved, the coverage cannot be terminated. Although the form states that the election shall remain operative until terminated in accordance with currently applicable regulations, employers can terminate the coverage under specific circumstances. It requires undergoing a proper procedure as defined by the Florida Department of Revenue, which includes notifying the department and the employees affected.

- Misconception 4: The form is only for employees who live in Florida. While one basis for election involves the employee's residence being in Florida, the form clearly allows for coverage of employees based on their work in Florida or their connection to a Florida-based place of business. This broader criterion encompasses a wider range of employees than just Florida residents.

- Misconception 5: Employers are not required to inform their employees about the RTS-6 election. On the contrary, one of the key stipulations of the form is the employer's agreement to notify each individual covered by the election promptly upon its approval. This ensures transparency and allows employees to understand their coverage under the state's reemployment assistance program.

- Misconception 6: Filling out and submitting the RTS-6 form is the only requirement for compliance. While crucial, the form submission is part of broader responsibilities. The employer agrees to comply with any requirements applicable to the election under the Florida Department of Revenue, which may include, but are not limited to, the proper calculation and payment of taxes, adherence to reporting obligations, and providing notices to employees.

By addressing these misconceptions directly, employers can better navigate the complexities surrounding the RTS-6 form and ensure they comply with Florida's legal requirements for covering their employees under the state's reemployment tax law.

Key takeaways

Filling out and using the Florida RTS 6 form requires attention to detail and understanding its specific functions. Here are some key takeaways to ensure clarity and compliance:

- The RTS 6 form enables employers to request coverage under Florida's reemployment tax for employees who perform services in multiple jurisdictions, aiming for a reciprocal coverage arrangement.

- Employers must identify each employee for whom they are seeking Florida reemployment tax coverage, including crucial details like the employee's social security number and legal residence.

- The form requires a detailed description of both the nature of the employer's business and the nature of the work performed by the employees listed.

- An essential part of the RTS 6 form is the justification for why the employer seeks to have the workers covered under Florida's law rather than the laws of other jurisdictions where services might be performed.

- Approval of the RTS 6 election means it remains effective until terminated according to Florida Department of Revenue regulations, requiring employers to stay informed about any changes in these regulations.

- Upon approval of the RTS 6 election, employers must notify each covered employee, using a notice supplied by the Florida Department of Revenue, and also file copies of this notice with the agency.

- The form also includes a provision to ensure that the election does not negatively impact the coverage of workers not listed on the form, allowing for their wages and work to be considered under the jurisdiction's laws if needed.

- For submission, two signed copies of the RTS 6 form must be sent to the Florida Department of Revenue for each jurisdiction involved, along with two additional copies for the department's use.

- Social security numbers are required for filling out the RTS 6 form and are used by the Florida Department of Revenue as unique identifiers for tax administration purposes, protected under confidentiality provisions.

- Finally, employers should be aware that the approval process involves both the state of Florida and any other interested jurisdictions, requiring an understanding of multi-jurisdictional tax laws.

Correct and thoughtful completion of the Florida RTS 6 form is crucial for employers who operate across state lines and seek to streamline their employees' reemployment tax obligations. It is always recommended to consult with a tax professional or legal advisor to ensure compliance with all applicable laws and regulations.

Popular PDF Documents

Income Withholding Order Florida - A gateway for payors to legally request the termination of wage deductions enforced by a court order in Florida.

Inheritance Tax in Florida - It ensures estate representatives meet their tax obligations to avoid penalties or legal issues.